“In one form or another (home or facility-based), as people age and/or become frail they will need someone to help care for them. That care will cost money, and that money has to come from somewhere. As the government’s ability to pick up the tab becomes more limited, people need to prepare to bear much of the financial burden on their own.” -Chris Orestis, President and founder of Life Care Funding Group

Many Americans seem to have the same attitude about saving for retirement as they do about eating healthy or exercising. They’re each something we know we ought to do, but when push comes to shove, many of us simply fall short. We know we must save for retirement, but don’t due to a number of obstacles or excuses such as loan debt, saving for a child’s college education, bills, “not making enough” to save and so on. But according to Cameron Huddleston, Life + Money columnist for GoBankingRates, “Although all of these things can put a strain on our budgets, they don’t necessarily make it impossible to save for retirement.”

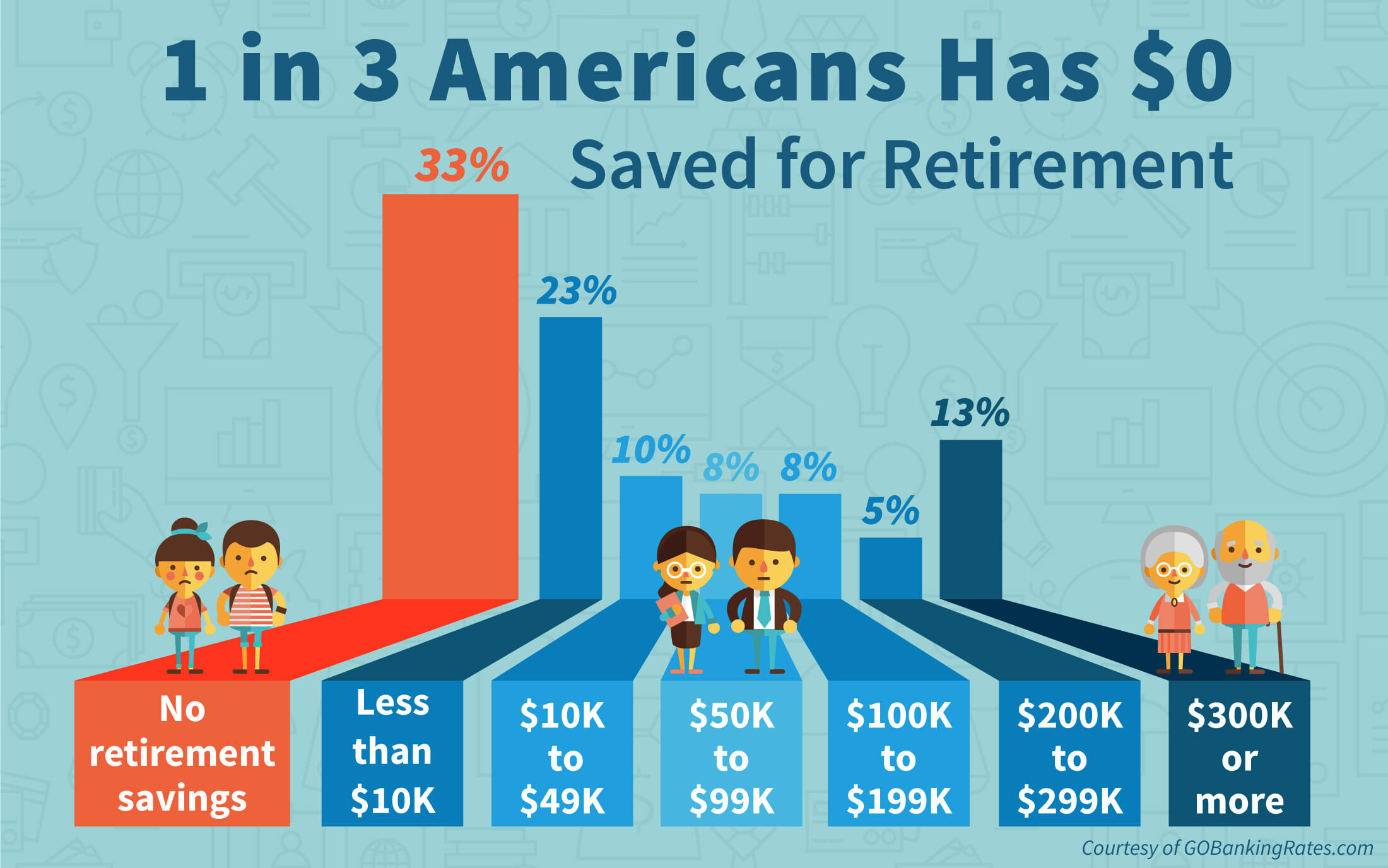

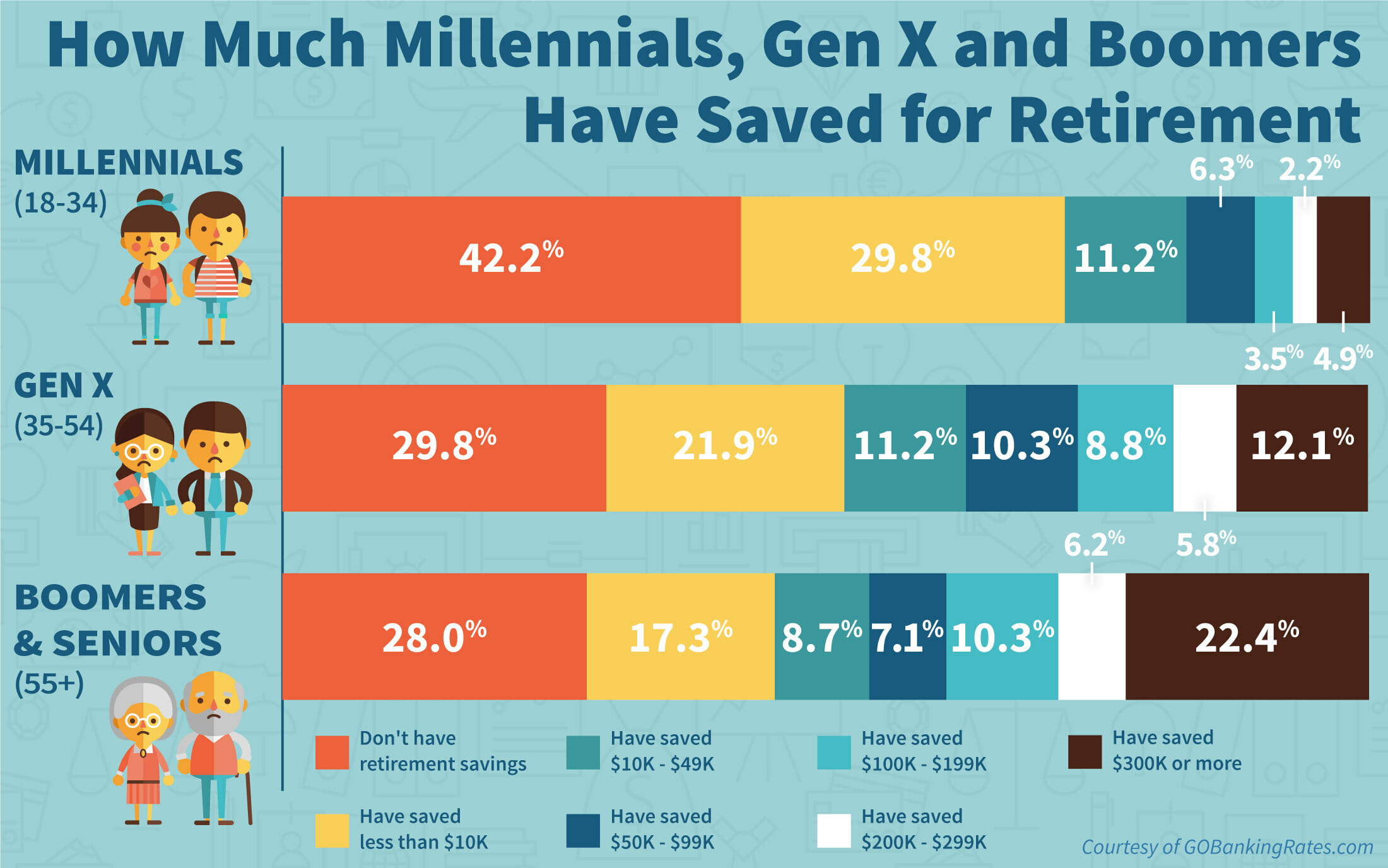

First, lets focus on the collective shortfalls. In a recent article from GoBankingRates, Elyssa Kirkham shares her perspective on statistical data regarding retirement savings (or lack of) here in the U.S. The GoBankingRates survey was conducted as three Google Consumer Surveys, each targeted at one of three age groups: millennials, Generation Xers, and baby boomers/seniors. Each age group was asked the same question, “By your best estimate, how much money do you have saved for retirement?”

Respondents could select one of the options as displayed below:

- Less than $10K

- $10K to $49K

- $50K to $99K

- $100K to $199K

- $200 to $299K

- $300K or more

- I don’t have retirement savings

The infographic (figure 1) shows the stark results of this survey. One-third of those surveyed have nothing saved for their retirement. Though this 33% includes those age 18-54 along with Boomers and Seniors age 55+, the data doesn’t get much better even after you isolate those age 55+. The percentage does drop, but only to 28% as indicated on the (figure 2) infographic. Regardless of the sample size or margins of error, these stats are unnerving nonetheless. A number of other studies support similar findings. See the Motley Fool article 20 Retirement Stats That Will Blow You Away, which paints an even grimmer picture statistically.

Longer Life Spans Changes Retirement Reality

We are all living longer, therefore the likelihood and need for long-term and health care services increases and thus the paying for these needs. But as we can see, many of us are not prepared or will fall short. Even for the 33.1% age 55+ that have saved $99K or less, the reality of long-term care costs can quickly eat those reserves when you consider the national median cost for one year of nursing care in a semi-private room is $82,815 or $43,539/year for assisted living (or personal care)¹. Most of these boomers and seniors with little to no savings will need to rely on Social Security income for basic needs. Social Security should be a supplement, not your sole income source. Additionally, many may need to apply for other funding sources like Medical Assistance (Medicaid) to pay for their long-term care needs. These funding sources leave less latitude for viable and desirable care options. Furthermore, many people are misinformed about what and how long Medicare and medigap plans will cover long-term need. The short answer – they don’t cover much. Many will face a harsh reality when the time comes for the care they need.

Articles like this are not here to scare you, but to serve as a wakeup call to initiate, bolster and/or realign current retirement savings strategies. It’s not too late and of course it’s never too early to save for retirement. Connect with a financial advisor or your employer to see what you can do create a healthier retirement fund. Also if you’d like to become more savvy at saving for retirement by getting a better handle on long-term care costs and coverage details, please consider attending “The Cost of Aging” workshop presented by Messiah Lifeways Coaching on May 18, 2017. Click here or call the Coaching office at 717.591.7225 for more information or to register for this upcoming workshop.

For the full article from Elyssa Kirkham, 1 in 3 Americans Has Saved $0 for Retirement, please click here.

Info graphics and certain excerpts of this article originally appeared on GoBankingRates.

¹Genworth 2016 Cost of Care Survey, conducted by CareScout®, April 2016

###